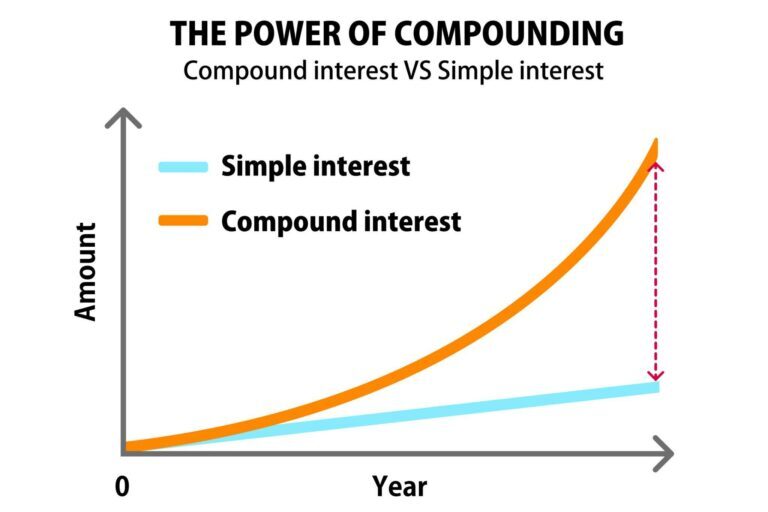

Compound interest is the key to building long-term wealth. It’s often called “interest on interest” because it allows investments to grow exponentially over time. The earlier you harness this concept, the better positioned you are to achieve financial independence.

What Is Compound Interest?

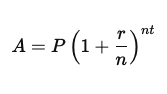

Compound interest means earning interest not just on your principal investment but also on accumulated interest.

Where:

- A = Final amount

- P = Principal

- r = Annual interest rate

- n = Times interest is compounded annually

- t = Number of years

Why Starting Early Matters

Investing early gives your money more time to grow. For example, someone investing $5,000 annually from age 25 will accumulate more by retirement than someone starting at 35—even if both contribute the same amount—because of the compounding effect over a longer period.

Practical Applications

- Savings Accounts & Fixed Deposits: Low-risk, with modest returns through regular compounding.

- Retirement Accounts (401(k), IRAs): Long-term investments that grow over decades with compound interest.

- Stock Market Investments: Reinvesting dividends accelerates growth through compounding.

The Double-Edged Sword: Debt

Compound interest can also work against you with high-interest debts, such as credit cards or payday loans. Debts that accumulate interest daily or monthly can grow quickly if left unpaid, creating financial burdens.

Tips to Maximize Compound Interest

- Start Early: More time means more growth.

- Automate Investments: Ensures consistent contributions and mitigates market fluctuations.

- Reinvest Returns: Keeps your earnings working for you.

- Look for Frequent Compounding: Monthly or quarterly compounding yields better results than annual compounding.

Compound Interest and Financial Independence

Many individuals in the FIRE (Financial Independence, Retire Early) movement leverage compound interest to retire early. By aggressively saving and investing during their prime years, they maximize long-term growth and reduce dependency on active income.

Conclusion

Compound interest is a powerful financial tool, whether in savings, retirement plans, or investments. Start early, stay consistent, and reinvest your gains to unlock exponential growth. With time on your side, compound interest can become your greatest ally in achieving financial independence.