1. Challenges in Finding the Right Personal Loan

Finding the right personal loan in Malaysia can be a challenging task for many people. You often face hurdles like:

- Too many options: With so many banks and lenders offering personal loans, it’s hard to know which one offers the best deal for your needs.

- Confusing details: Loan terms, interest rates, and hidden fees can be overwhelming, especially when you’re trying to make sense of what you’ll actually end up paying.

- Time-consuming: Going to different bank branches or browsing through various websites to compare loans can take hours or even days.

2. How Ringgit Plus Makes It Easier

This is where Ringgit Plus steps in. Specifically, it simplifies the personal loan search process by providing a platform where you can compare loan options from top Malaysian banks in one place. Instead of manually checking multiple sources, you can easily view and evaluate the best deals quickly and clearly.

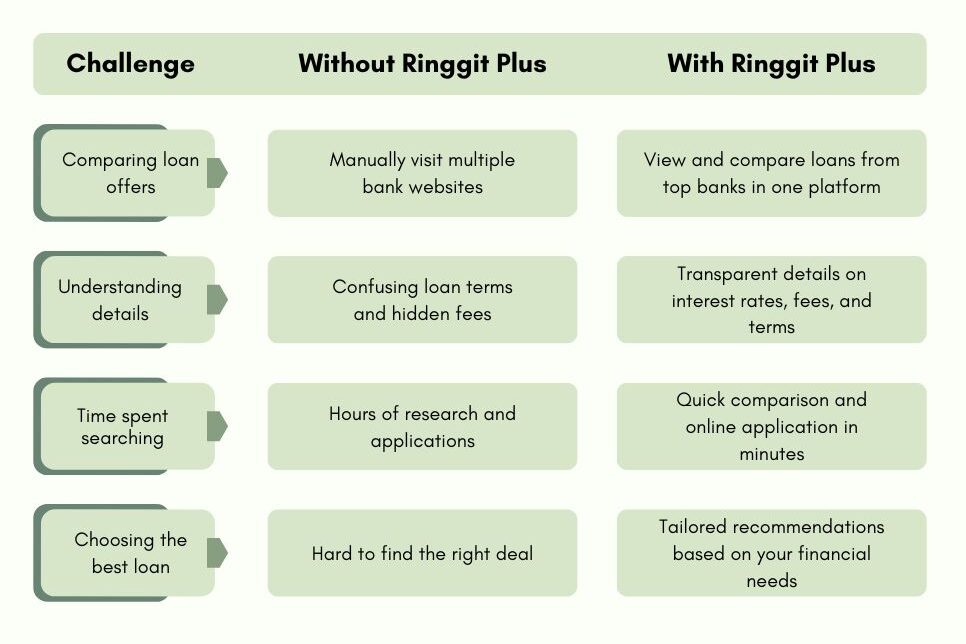

Here’s a side-by-side comparison of how the personal loan search differs when using Ringgit Plus versus doing it yourself:

3. Benefits of Ringgit Plus:

- Clear comparisons: Ringgit Plus allows you to compare loans from top Malaysian banks side by side. This makes it easy to find the best deal for you.

- No hidden fees: The platform offers transparent information on interest rates, fees, and terms. This way, there are no surprises later.

- Saves time: Instead of spending hours on research, Ringgit Plus lets you compare and apply for loans online in just a few minutes.

- Tailored options: Ringgit Plus provides personalized recommendations based on your financial situation and eligibility. This helps you make smarter financial decisions.

4. How to Use Ringgit Plus to Find Your Personal Loan

Using Ringgit Plus is simple:

- Visit the platform: Go to the Ringgit Plus website.

- Enter your details: Provide some basic information about yourself, such as your desired loan amount and tenure.

- Compare loans: The platform will show you a range of personal loan offers from top banks, complete with interest rates and repayment details.

- Apply online: Once you’ve found the best loan for your needs, you can apply directly through the platform without visiting a bank branch.

Ringgit Plus takes the hassle out of finding a personal loan, ensuring that you get the best possible deal for your financial situation in Malaysia. By using this platform, you can effortlessly compare various loan options from top banks, which ultimately saves you time and effort. Moreover, Ringgit Plus provides clear information on interest rates and terms, allowing you to make informed decisions. As a result, you can feel confident that you are choosing a loan that best fits your needs and budget.