Budgeting is an essential tool for managing your finances and achieving your financial goals. A well-planned budget not only helps you track income but also allows you to control spending and save for future needs. By following these steps, you can create a personal budget that works and stick to it effectively.

Step 1: Determine Your Income

To start, calculate your total monthly income. This includes not only your salary but also any side income or investments. Understanding how much money you have coming in is crucial to creating a realistic budget that you can follow consistently.

Step 2: List Your Expenses

Next, write down all your monthly expenses. It’s important to categorize them into two groups:

- Fixed Expenses: Rent, mortgage, utilities, loan payments, and insurance. These are recurring and usually predictable costs.

- Variable Expenses: Groceries, entertainment, dining out, and transportation. These fluctuate from month to month but are equally important to track.

Step 3: Set Financial Goals

Once your expenses are listed, define both short-term and long-term financial goals. For instance, short-term goals might include paying off credit card debt or saving for a vacation, while long-term goals could focus on building an emergency fund or preparing for retirement. Prioritizing these goals in your budget ensures that you’re saving for both the immediate future and the long haul.

Step 4: Allocate Funds

Now that you know your income and expenses, it’s time to allocate funds to each category. A common method is the 50/30/20 rule:

- 50% for necessities (such as rent, food, and bills)

- 30% for wants (such as entertainment and dining out)

- 20% for savings and debt repayment

This approach ensures you cover your essentials first, while also leaving room for savings and enjoying life.

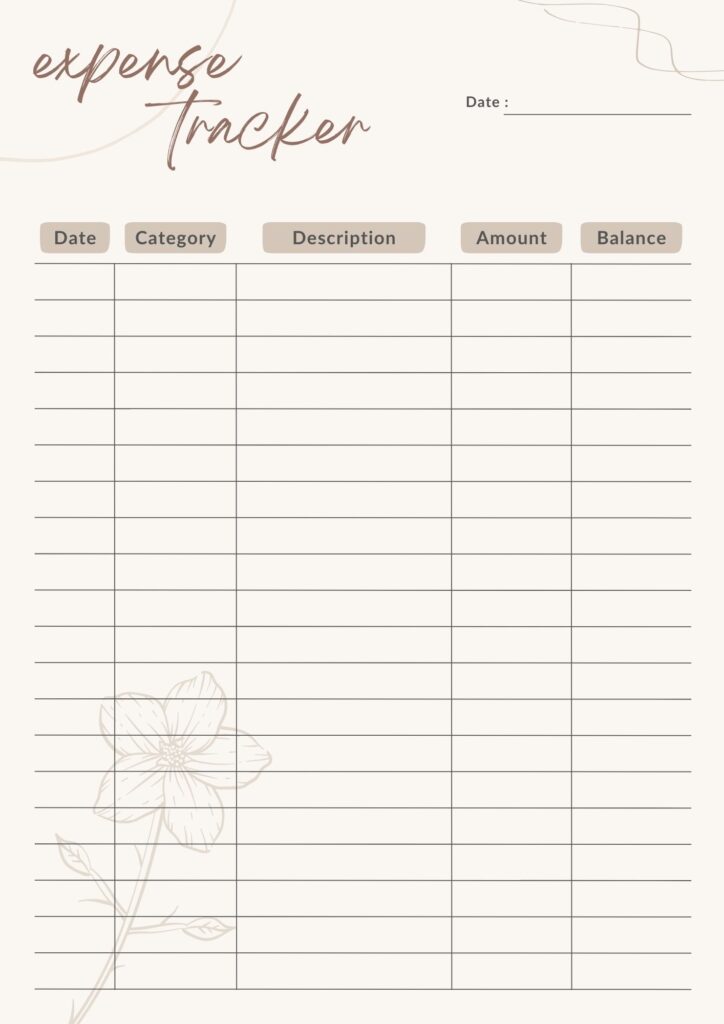

Step 5: Track Your Spending

After you’ve allocated funds, it’s crucial to track your daily spending to ensure you’re sticking to your budget. You can do this with the help of budgeting apps, spreadsheets, or even a simple notebook. Tracking spending consistently helps you identify areas where you might be overspending and where adjustments can be made.

Step 6: Adjust as Needed

Your budget isn’t set in stone. Therefore, it’s important to review it regularly. Life changes, such as a salary increase or unexpected expenses, may require adjustments. Make sure to review your budget on a monthly basis and tweak it to reflect your current financial situation. This flexibility will help keep you on track despite changes.

Step 7: Stick to Your Budget

Finally, sticking to your budget requires discipline. Here are some tips to help you stay on course:

- Use cash for discretionary spending: It’s easier to control spending when you physically see the money leave your hands. Consider using cash for non-essential purchases like entertainment or dining out.

- Set reminders: Use alerts or calendar notifications to remind yourself when bills are due or when you’re nearing the spending limit for a specific category.

- Reward yourself: When you reach a financial milestone, celebrate with a small treat—but make sure it fits within your budget. This will keep you motivated to continue budgeting.

Conclusion

Creating and sticking to a personal budget takes time and effort, but the rewards are well worth it. By following these steps and adjusting when necessary, you’ll gain better control of your finances and be on your way to achieving your financial goals with confidence.