Bitcoin has once again taken the financial world by storm, reaching a record-breaking $89,000. This 30% increase over just seven days post-U.S. election highlights the cryptocurrency’s return to center stage as an asset class of global interest. Investors and analysts are buzzing with speculation as they examine what drove this remarkable price surge and what it might signal for Bitcoin’s future trajectory.

Bull Market on the Horizon — But Not Yet

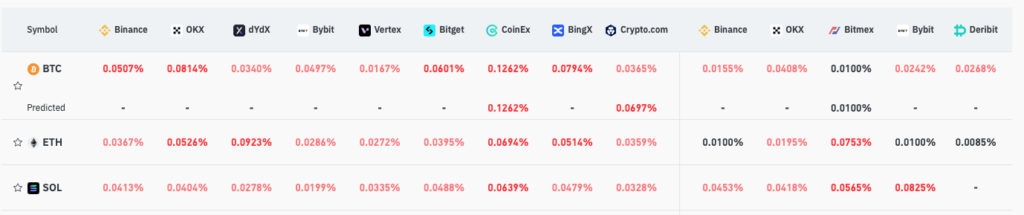

Bitcoin’s surge to $89,000 suggests potential for a bull market, but we’re not there yet. The funding rate remains normal, indicating only modest profits for a few investors so far. However, the recent U.S. election has put crypto in the spotlight, attracting interest that could soon translate into a wave of new funds in the industry, setting the stage for a possible full-scale bull run.

Institutional Demand and the Bitcoin Supply Crunch

Institutional demand for Bitcoin is rapidly rising. Financial institutions, hedge funds, and public companies are increasingly adding Bitcoin to their balance sheets. This surge in demand is pushing up prices and coincides with Bitcoin’s limited supply of only 21 million coins. As more investors buy and hold Bitcoin, its price may keep climbing over the long term.

Potential Future Price Movements of Bitcoin

Many analysts are now recalculating their forecasts for Bitcoin, suggesting it could potentially reach six-figure valuations in the near future. However, such predictions come with considerable caution, as the crypto market’s volatility makes price forecasting challenging. While Bitcoin has proven resilient, capable of recovering from downturns, its journey to $89,000 has also been marked by steep corrections.

Planning Ahead: Key Strategies for Crypto Investors

Investors considering Bitcoin should aim for a gradual, disciplined buying strategy to manage volatility. Diversification is essential, blending both traditional and alternative assets.

Bitcoin’s rally to $89,000 after the election highlights its growing role in finance, especially during political and economic shifts. As this period unfolds, both seasoned and new investors will watch closely to see if Bitcoin can maintain or exceed these new levels.