Compound interest is often called the “eighth wonder of the world” because of its power to grow wealth over time. Furthermore, it works as a catalyst for financial growth, allowing your money to multiply. Whether you’re saving for retirement or a significant purchase, understanding and leveraging compound interest can help you achieve your financial goals. In this article, we’ll break down the basics and share actionable steps to maximize its potential.

1. What is Compound Interest?

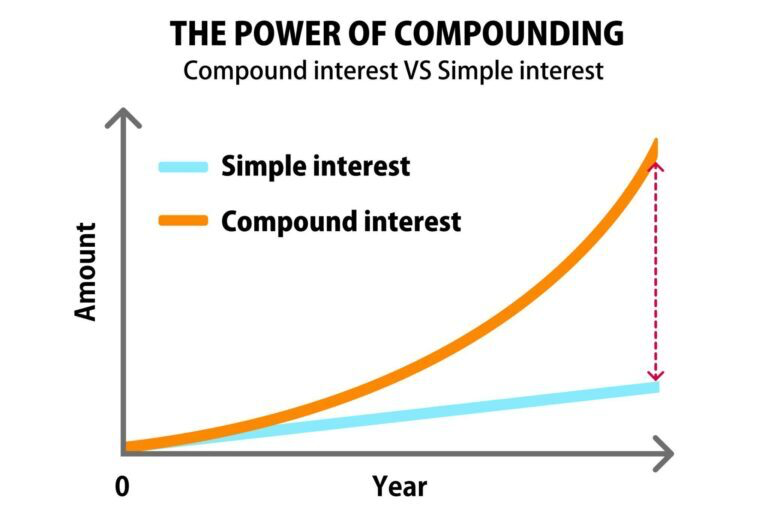

Compound interest is the process where your money earns interest on both the initial principal and the accumulated interest over time. Unlike simple interest, which only grows based on the principal, compound interest accelerates your growth exponentially.

For example:

- Simple Interest: $1,000 at 5% annually for 10 years = $500

- Compound Interest: $1,000 at 5% annually for 10 years = $628.89

2. Start Early to Maximize Growth

The earlier you start, the more you can benefit from compound interest. Time is the most critical factor because the longer your money compounds, the more significant the growth.

Example:

- Person A starts at 25: $200/month for 10 years, total saved = $24,000, grows to $110,000 by 65.

- Person B starts at 35: $200/month for 30 years, total saved = $72,000, grows to $98,000 by 65.

Starting earlier often beats investing more later.

3. Choose High-Interest Savings Options

To maximize compound interest, opt for accounts or investments with higher returns, such as:

- High-Yield Savings Accounts

- Certificates of Deposit (CDs)

- Index Funds or ETFs

Compare interest rates and terms to ensure your money works hardest for you.

4. Reinvest Your Earnings

Reinvesting dividends or interest payments back into your account allows for continuous compounding. For example:

- Stock Dividends: Reinvest dividends to purchase more shares.

- Mutual Funds: Opt for growth options that automatically reinvest profits.

This approach ensures your wealth grows faster without additional contributions.

5. Avoid Unnecessary Withdrawals

Frequent withdrawals can disrupt the compounding process. For long-term goals like retirement, consider accounts with penalties for early withdrawals, such as:

- Individual Retirement Accounts (IRAs)

- 401(k) Plans

These restrictions help protect your savings from impulsive spending.

6. Understand the Rule of 72

The Rule of 72 is a quick formula to estimate how long it takes for your investment to double at a fixed annual interest rate.

Formula: 72 ÷ Interest Rate = Years to Double

- At 6% interest, your money doubles in approximately 12 years.

Use this rule to assess the growth potential of various accounts or investments.

Conclusion

Compound interest is a powerful tool for building wealth, but it requires discipline and time. By starting early, choosing high-yield options, and reinvesting earnings, you can maximize its benefits. Make compound interest your ally in achieving financial stability and freedom.