The T15 group refers to the top 15% of households by income in Malaysia, introduced under Budget 2025 to facilitate more targeted subsidies and economic policies. Specifically, this group is a subset of the broader T20 income group, which encompasses the wealthiest 20% of households. By narrowing the focus, the government aims to refine policies that better align with varying income levels across regions. Therefore, T15 serves not just as an income classification but as a tool to ensure subsidy allocation is both efficient and fair.

Income Thresholds for T15

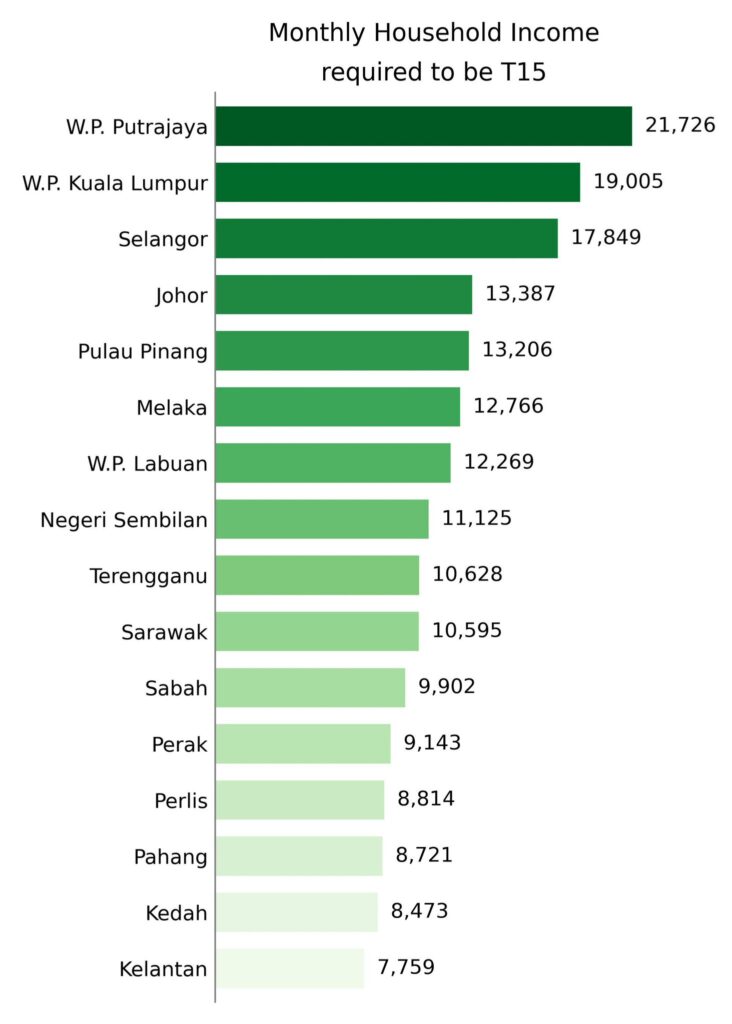

The threshold for being classified as part of the T15 group varies significantly across Malaysia’s regions. For example:

- In Putrajaya, the threshold is the highest, at RM21,726 per month.

- In Kuala Lumpur, it stands at RM19,005, and in Selangor at RM17,849.

- In states like Kelantan and Kedah, the threshold is much lower, starting around RM7,759 and RM8,473, respectively.

This variation reflects the differences in the cost of living and economic conditions across the country. A household that qualifies as T15 in one state may not experience the same financial comfort in another.

Policy Implications

With the introduction of T15, the government aims to reduce subsidies for higher-income households. For instance:

- RON95 petrol subsidies will be revised in mid-2025, meaning T15 households will pay higher prices compared to the rest of the population.

- Education subsidies for children of T15 families attending fully residential schools and public universities will be phased out.

Comparison with Other Income Groups

- T20: Refers to the top 20% of households, with incomes starting at RM11,820 per month.

- M40: Represents the middle 40% of households, with incomes between RM5,250 and RM11,819.

- B40: Covers the bottom 40% of households, focusing on the lower-income population.

These distinctions allow policymakers to better target welfare programs and subsidies to those most in need, ensuring more efficient resource allocation.

Conclusion

The introduction of T15 in Malaysia signals a shift toward targeted welfare policies, aiming to balance national subsidies more fairly. However, this classification not only seeks to address income inequality but also introduces challenges. For instance, managing public perception and ensuring smooth policy execution, especially in states with lower income thresholds, will require careful planning. Moreover, the move reflects Malaysia’s commitment to modernizing its economic framework, while simultaneously navigating the complexities of a diverse socioeconomic landscape.